Browse discussions

Pinned by community manager

Pinned by community managerSeller_khUF6HPR2AHxu∙

Seller_GEZPMc4CeQfh6∙

Seller_khUF6HPR2AHxu∙

Seller_khUF6HPR2AHxu∙

Seller_CnfW62x6yxvJw∙

Seller_4GjtS9k0cnHHv∙in New Seller Community group

Seller_khUF6HPR2AHxu∙

Seller_FJwyF3iu5qxUY∙in Handmade Community group

Seller_CnfW62x6yxvJw∙

Seller_4GjtS9k0cnHHv∙in New Seller Community group

Seller_GEZPMc4CeQfh6∙

Sort by

Filters

Date/timeAll Time Past day Past week Past month Past 3 months Past year Date Range

Browse discussions

Pinned by community manager

Pinned by community managerSeller_khUF6HPR2AHxu∙

🚨 ASK AMAZON - GET ANSWERS on all things Handmade on March 5th

by Seller_khUF6HPR2AHxu

Latest activity

Seller_GEZPMc4CeQfh6∙

📚 Browsing the Shelves with Booksellers - What Are You Reading? 📚

by Seller_GEZPMc4CeQfh6

Latest activity

Seller_khUF6HPR2AHxu∙

[Now Closed] Ask Amazon - GET ANSWERS on Brand Registry’s Trademark and Roles on February 27th

by Seller_khUF6HPR2AHxu

Latest activity

Seller_khUF6HPR2AHxu∙

[Now Closed] Ask Amazon - GET ANSWERS on tax season and managing finances on February 25

by Seller_khUF6HPR2AHxu

Latest activity

Seller_CnfW62x6yxvJw∙

Top Success Factors for Your Amazon Listings 📈

by Seller_CnfW62x6yxvJw

Latest activity

Seller_4GjtS9k0cnHHv∙in New Seller Community group

New Seller Community Digest (February 12th edition)

by Seller_4GjtS9k0cnHHv

in New Seller Community group

Latest activity

Seller_khUF6HPR2AHxu∙

[Now Closed] Ask Amazon - GET ANSWERS about Product Lifecycle Support on February 20th

by Seller_khUF6HPR2AHxu

Latest activity

Seller_FJwyF3iu5qxUY∙in Handmade Community group

Thank You for a Fantastic Ask Amazon Event!

by Seller_FJwyF3iu5qxUY

in Handmade Community group

Latest activity

Seller_CnfW62x6yxvJw∙

Let's Talk About Two-Step Verification! 🔐

by Seller_CnfW62x6yxvJw

Latest activity

Seller_4GjtS9k0cnHHv∙in New Seller Community group

📦 NEW SELLERS CORNER: Share Your First 180 Days Journey!

by Seller_4GjtS9k0cnHHv

in New Seller Community group

Latest activity

Seller_GEZPMc4CeQfh6∙

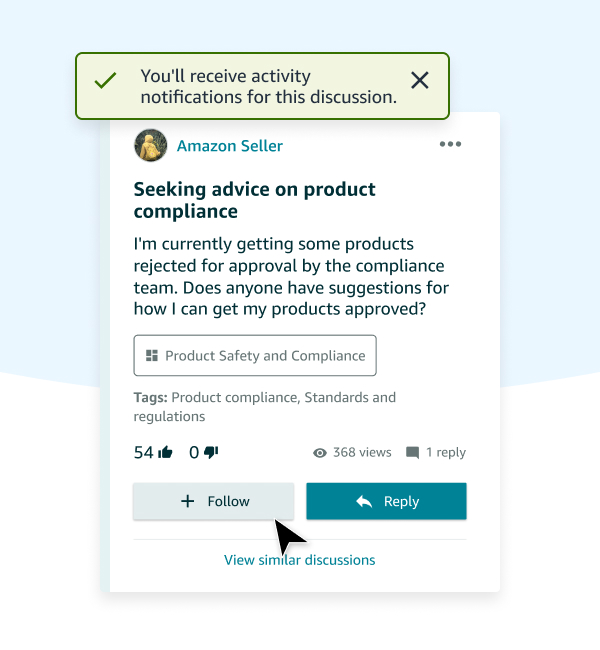

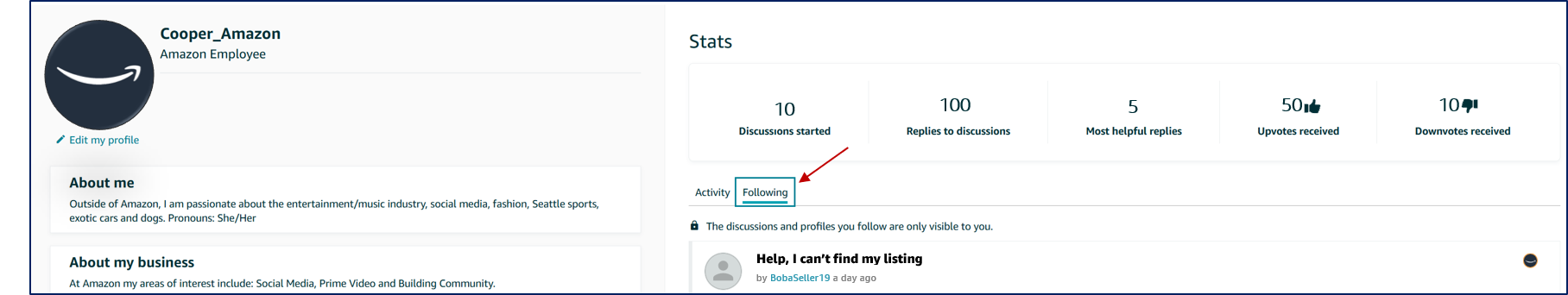

Forums Feature Launch: Follow Discussions

by Seller_GEZPMc4CeQfh6

Latest activity